Is Your CPA Future-Proof?

Is Your CPA Future-Proof?

5 Signs You Need More Than Compliance

by: Joy Francis, CFO & AI Automation Strategist | October 14, 2025 8 min read

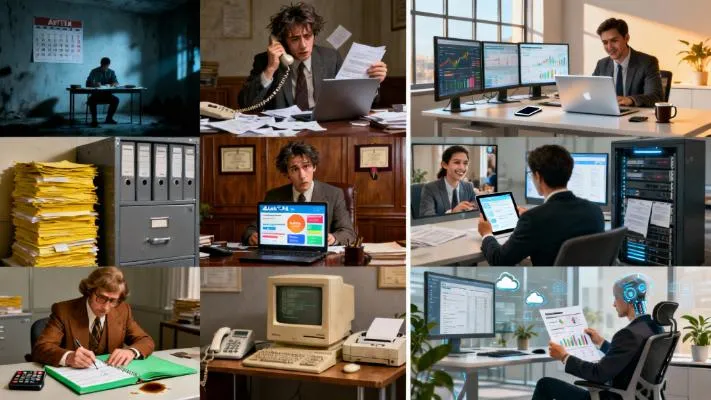

Figure 1: Created with Seedream 4.0 by Joy Francis

QUICK ANSWER BOX

The 5 red flags your CPA is stuck in the past are:

Only showing up at tax time – Modern financial partners provide year-round strategic guidance

Being reactive instead of proactive – You need forward-looking planning, not just historical reporting

Not understanding your business model – Industry-specific expertise is essential for relevant advice

Using outdated tools and processes – Technology should make your life easier, not harder

Being unable to explain things in plain English – Financial clarity is your right, not a privilege

If you're experiencing these red flags, it's time to explore what modern financial partnership really looks like.

·Tax Season Calendar→ Red Flag #1 section

·Past vs. Present Split-Screen→ Red Flag #4 section

·Empowered Entrepreneur→ Red Flag #5 section

·Collaborative Partnership→ "What You Should Expect from a Modern Financial Partner" section

Let me tell you something I see all the time: brilliant business owners who are absolutely crushing it in their industry, but they're being held back by their financial advisor.

I'm not talking about bad people or incompetent professionals. I'm talking about CPAs who are stuck in an outdated model of what financial services should look like. They're doing what they've always done, but the business world has evolved—and if your financial partner hasn't evolved with it, you're leaving money, growth, and peace of mind on the table.

Here's the truth: Your CPA should be one of your most valuable business partners. Not just someone who shows up once a year with a tax bill, but someone who helps you make better decisions, spot opportunities, and build the business you want.

So how do you know if your CPA is stuck in the past? Let's talk about the red flags—and more importantly, what you should expect instead.

STATISTICS BOX

Did you know?

67% of small business owners feel their accountant doesn't truly understand their business model

Businesses with proactive financial advisors grow 2.3x faster than those with reactive accountants

78% of successful entrepreneurs cite strategic financial guidance as critical to their growth

Sources: [Industry Research Studies

Red Flag #1: They Only Show Up at What This Looks Like

Figure 2: Created with Seedream 4.0 by Joy Francis

You hear from your CPA in March. They send you a list of documents they need. You scramble to pull everything together. They prepare your return, you sign it, and then... crickets until next year.

Sound familiar?

Why This Is a Problem

Here's what's happening: You're getting compliance, not strategy.

Yes, filing your taxes correctly is important. But if that's ALL your CPA is doing, you're missing out on 11 months of potential guidance, optimization, and planning.

Think about it: Would you only talk to your doctor when you're already sick? Would you only meet with your business coach when things are falling apart? Of course not. So why is your financial advisor only showing up when it's time to report what already happened?

The Real Cost

When your CPA only shows up at tax time, you miss:

Quarterly tax planning that could save you thousands

Strategic decisions about when to make purchases, hire employees, or invest in growth

Early warning signs of cash flow problems or profitability issues

Opportunities to restructure your business for better tax treatment

What to Look for Instead

A modern financial partner operates on a year-round relationship model. This means:

Regular check-ins (at minimum quarterly, ideally monthly)

Proactive outreach when they spot opportunities or concerns

Strategic planning sessions to align your finances with your business goals

Real-time guidance when you're making important decisions

You should never be surprised by your tax bill. You should never wonder if you're making the right financial move. Your financial partner should be accessible, engaged, and invested in your success—not just your tax return.

[CTA BOX: Not sure if your CPA is providing enough support? Download our free "Financial Partner Evaluation Checklist" to assess your current relationship. → DOWNLOAD NOW]

Red Flag #2: They're Reactive, Not Proactive

What This Looks Like

You reach out with questions. They respond (eventually). You ask for advice. They tell you what you can't do, or what you should have done differently. But they never come to you first with ideas, strategies, or opportunities.

Why This Is a Problem

Reactive financial advice is like driving while only looking in the rearview mirror. Sure, you can see where you've been, but you have no idea what's coming or where you're going.

The business landscape changes constantly. Tax laws change. Your industry evolves. Your business grows. If your CPA is only responding to what's already happened, you're always going to be one step behind.

A Real-World Example

I once worked with a client who came to me frustrated. She'd had a huge revenue spike in Q3, and when tax time came, she was hit with a massive tax bill she wasn't prepared for. When she asked her previous CPA why she hadn't been warned, the response was: "Well, you didn't ask."

That's reactive thinking. A proactive advisor would have seen that revenue spike, reached out immediately, and helped her implement strategies to manage the tax impact BEFORE it became a problem.

What to Look for Instead

A proactive financial partner:

Monitors your numbers regularly and reaches out when they spot trends (good or bad)

Brings you ideas for optimization, tax savings, and strategic moves

Anticipates challenges before they become crises

Asks questions about your goals and plans, then helps you build financial strategies to support them

Educates you on changes in tax law or industry standards that might affect you

The relationship should feel like a partnership, not a service transaction. Your financial advisor should know your business well enough to think ahead on your behalf.

Red Flag #3: They Don't Understand Your Business Model

What This Looks Like

You explain what you do, and you get blank stares. You ask industry-specific questions, and they give generic answers. They treat your service-based business like it's a retail shop or a manufacturing company.

Why This Is a Problem

Generic advice is useless advice.

A CPA who doesn't understand your business model can't give you relevant guidance. They don't know the typical profit margins in your industry. They don't understand your revenue cycles. They can't spot the opportunities or red flags that are specific to how you operate.

Even worse, they might give you advice that's actually harmful because it doesn't account for the realities of your business.

The Cost of Generic Advice

I've seen this play out in painful ways:

A consultant told to structure her business like a product company, creating unnecessary complexity

A coach advised to keep inventory metrics that made no sense for her service model

A creative agency given cash flow advice that didn't account for project-based revenue cycles

What to Look for Instead

Your financial partner should:

Specialize in or have significant experience with your industry

Speak your language and understand your business model without lengthy explanations

Provide benchmarks relevant to your industry (What should your profit margin be? What's normal for client payment terms?)

Offer strategic advice that accounts for how your specific business operates

Connect you with resources and best practices from others in your field

When you're talking to a potential financial advisor, ask them: "How many clients do you work with in my industry?" and "Can you give me an example of strategic advice you've given someone with a similar business model?"

If they can't answer confidently, keep looking.

[CTA BOX: Want to work with someone who truly understands service-based businesses? Learn more about Joy's specialized approach to financial partnership. → LEARN MORE]

Red Flag #4: They Use Outdated Tools and Processes

Figure 3: Created using Seedream 4.0 by Joy Francis

What This Looks Like

They want you to print out reports and mail them. They use software you've never heard of (or worse, Excel spreadsheets from 1995). They can't integrate with your existing systems. Getting information to them or from them feels like pulling teeth.

Why This Is a Problem

We live in an era of incredible financial technology. There are tools that can:

categorize your transactions

Provide real-time dashboards of your financial health

Integrate seamlessly with your other business systems

Generate reports at the Automatically click of a button

Facilitate secure, instant document sharing

If your CPA isn't using modern tools, they're making both of your lives harder than they need to be. More importantly, they're limiting the quality and timeliness of the insights they can provide.What This Looks Like

They want you to print out reports and mail them. They use software you've never heard of (or worse, Excel spreadsheets from 1995). They can't integrate with your existing systems. Getting information to them or from them feels like pulling teeth.

Why This Is a Problem

We live in an era of incredible financial technology. There are tools that can:

categorize your transactions

Provide real-time dashboards of your financial health

Integrate seamlessly with your other business systems

Generate reports at the Automatically click of a button

Facilitate secure, instant document sharing

If your CPA isn't using modern tools, they're making both of your lives harder than they need to be. More importantly, they're limiting the quality and timeliness of the insights they can provide.

The Real Impact

Outdated processes mean:

Delayed information – By the time you see your numbers, they're weeks or months old

More work for you – Manual data entry and document gathering

Higher costs – Inefficient processes take more time (and you're paying for that time)

Limited visibility – You can't see your financial picture in real-time

Increased errors – Manual processes are more prone to mistakes

What to Look for Instead

A modern financial partner:

Uses cloud-based tools that you can both access anytime, anywhere

Integrates with your existing systems (your bank, payment processors, project management tools, etc.)

Provides real-time dashboards so you always know where you stand

Communicates digitally through secure portals, video calls, and shared documents

Stays current with new technologies and tools that could benefit your business

Ask potential advisors: "What tools do you use?" and "How will we share information and communicate?" Their answers will tell you a lot about whether they're keeping up with the times.

Red Flag #5: They Can't Explain Things in Plain English

Figure 4: Created with Seedream 4.0 by Joy Francis

What This Looks Like

Every conversation is filled with jargon. When you ask questions, the answers are more confusing than the original problem. You leave meetings feeling stupid instead of empowered. You're afraid to ask questions because you don't want to look ignorant.

Why This Is a Problem

Here's the truth: If your CPA can't explain something in plain English, they either don't understand it well enough themselves, or they're not prioritizing your understanding.

Neither is acceptable.

Your financial advisor's job isn't just to know the numbers—it's to help YOU understand the numbers so you can make informed decisions. Financial literacy is power, and a good advisor wants to empower you, not keep you dependent on them.

The Empowerment Gap

When you don't understand your finances:

You can't make confident decisions

You feel anxious about money

You're dependent on others to tell you what to do

You miss opportunities because you don't recognize them

You can't communicate effectively with investors, partners, or lenders

This isn't just frustrating—it's limiting your potential as a business owner.

What to Look for Instead

A great financial partner:

Explains concepts in simple, relatable terms

Uses analogies and examples that make sense for your life

Welcomes questions and never makes you feel stupid for asking

Teaches as they go, helping you build financial literacy over time

Provides context for why numbers matter and what they mean for your decisions

Checks for understanding rather than just talking at you

You should leave every conversation with your financial advisor feeling clearer and more confident, not more confused.

Your financial advisor should be a translator, not a gatekeeper. If you don't understand your numbers, that's on them, not you. – Joy Francis]

What You Should Expect from a Modern Financial Partner

Okay, so we've talked about what to avoid. But what should you actually expect? What does a modern, strategic financial partnership look like?

1. Year-Round Strategic Partnership

Your financial advisor should be:

Meeting with you regularly (at least quarterly, ideally monthly)

Reviewing your numbers proactively

Helping you plan for the future, not just report on the past

Available when you need guidance on important decisions

2. Proactive Planning and Forecasting

Instead of just telling you what happened, they should:

Help you forecast future revenue and expenses

Model different scenarios ("What if I hire someone?" "What if I raise my prices?")

Identify opportunities for tax savings and optimization

Warn you about potential challenges before they become problems

3. Industry-Specific Expertise

They should:

Understand your business model and industry

Provide relevant benchmarks and comparisons

Offer strategic advice tailored to how your business operates

Connect you with resources specific to your field

4. Modern Technology and Tools

Expect:

Cloud-based systems you can access anytime

Real-time financial dashboards

Integration with your existing tools

Efficient, digital communication and document sharing

5. Clear, Empowering Communication

Your advisor should:

Explain things in plain English

Welcome and encourage questions

Help you build financial literacy

Make you feel confident, not confused

6. Strategic Advisory, Not Just Compliance

Beyond tax preparation, they should help with:

Pricing strategy and profitability analysis

Cash flow management and forecasting

Business structure optimization

Growth planning and financial goal-setting

Key performance indicator (KPI) tracking

7. A True Partnership Mindset

The relationship should feel collaborative:

Figure 5: Created with Seedream 4.0 by Joy Francis

They know your goals and values

They're invested in your success

They bring ideas and opportunities to you

They celebrate your wins and support you through challenges

COMPARISON TABLE

Traditional CPA Modern Financial Partner

Annual tax preparation Year-round strategic planning

Historical reporting Forward-looking forecasting

Generic advice Industry-specific guidance

Manual processes Automated, integrated systems

Technical jargon Clear, plain-English explanations

Reactive responses Proactive outreach

Compliance focus Strategic advisor

Transactional relationship True partnership

You reach out to them. They reach out to you

"Here's what happened" "Here's what's possible"

Questions to Ask When Evaluating a Financial Advisor

If you're considering making a change (or just want to evaluate your current relationship), here are the questions you should ask:

About the Relationship:

How often will we meet throughout the year?

How do you typically communicate with clients between meetings?

What's your response time when I have questions?

Do you proactively reach out, or do I need to initiate contact?

About Their Expertise:

How many clients do you work with in my industry?

Can you give me an example of strategic advice you've given someone with a similar business model?

What's your experience with [specific aspect of your business]?

About Their Approach:

What financial forecasting and planning tools do you use?

How do you help clients with strategic decision-making?

What does proactive tax planning look like in your practice?

About Technology:

What software and tools do you use?

Can you integrate with my existing systems?

Will I have real-time access to my financial information?

About Communication:

How do you explain complex financial concepts to clients?

What's your philosophy on financial education for business owners?

Can you give me an example of how you've helped a client understand their numbers better?

Pay attention not just to their answers, but to how they make you feel. Do they seem genuinely interested in your business? Do they ask thoughtful questions? Do you feel like they "get" you?

Making the Transition

If you're reading this and realizing your current CPA isn't meeting your needs, you might be wondering: "How do I make a change without creating chaos?"

It's Easier Than You Think

Many business owners stay with inadequate financial advisors because they're afraid of the transition. But here's the truth: A good financial advisor will make the transition smooth and painless.

They'll:

Handle the communication with your previous CPA

Request all necessary documents and files

Review your historical information to get up to speed

Create a transition plan that doesn't disrupt your operations

You Don't Have to Wait Until Tax Season

Another common misconception: "I'll wait until after tax season to make a change."

While there are strategic times to transition, you don't have to wait if you're currently not getting the support you need. A proactive advisor can start helping you immediately with strategic planning, even if your previous CPA handles this year's tax return.

The Cost of Waiting

Every month you spend with an inadequate financial advisor is a month of:

Missed opportunities

Unnecessary stress

Potential tax savings left on the table

Strategic decisions made without proper guidance

The best time to make a change is when you realize you need one.

PERSONAL NOTE FROM JOY FRANCIS

I want to share something personal with you.

Early in my own business journey, I had an accountant who checked all the traditional boxes. Credentialed, experienced, professional. But something was missing.

I'd leave our annual meeting feeling more anxious than when I went in. I'd have questions throughout the year but felt like I was bothering them. I'd make big business decisions and wonder if I was doing the right thing financially, but I didn't have anyone to ask.

It wasn't until I experienced what a true financial partnership could look like that, I realized what I'd been missing. And it changed everything.

That's why I'm so passionate about this work. I've been on both sides—I know what it feels like to be in the dark about your own finances, and I know the incredible freedom that comes from having a financial partner who truly supports your vision.

You deserve more than compliance. You deserve strategy. You deserve clarity. You deserve a partner who's as invested in your success as you are.

If you're experiencing any of these red flags, I want you to know: It doesn't have to be this way. There's a better model out there, and it's waiting for you.

Ready to Experience the Difference?

If you're tired of outdated accounting practices and ready to experience what modern financial partnership really looks like, I'd love to talk with you.

Here's what we'll cover in a free consultation:

Your current financial situation and challenges

Your business goals and vision for growth

How strategic financial guidance could support your specific needs

Whether we're a good fit to work together

There's no pressure, no sales pitch—just a genuine conversation about your business and how the right financial partnership could transform your operations.

Schedule Your Free Consultation

Not Ready for a Consultation Yet?

I get it. Here are some other ways to explore whether a modern financial approach is right for you:

📧 Subscribe to our Newsletter Join hundreds of business owners receiving weekly financial insights and strategies

📚 Explore Our Blog: Read more about Joy's approach to financial partnership and client success stories