The $10,000 Question: What's the Difference Between a CPA and a CFO?

By Joy Francis, CFO & AI Automation Strategist

The phone rang at 6 AM on the first morning of my honeymoon. Well, technically it wasn't a honeymoon yet—we'd decided to postpone the trip because my apartment ceiling had caved in two weeks before the wedding, and we were still dealing with the chaos. But that's another story.

My new husband rolled over and handed me the phone. "Joy, this is Jack from Cleveland. Is Joy there?"

That call changed everything. Jack worked at the Cleveland Ford Casting Plant, and he wanted me to come teach financial classes to his employees. But what he said next stopped me cold: "We've had CPAs come through here before, but what you do is different. You don't just show them the numbers—you show them what to do with them."

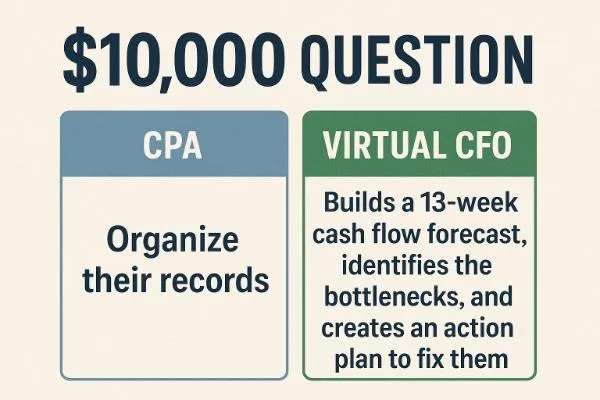

That's when it hit me. Jack had just articulated the $10,000 question that every business owner asks but most CPAs never hear: What's the difference between a CPA and a CFO?

The answer to that question is worth exactly what you think it's worth. And if you think it's worth $10,000 more per client per year, you're probably underestimating.

The Day I Learned the Difference

Let me take you back to 1980. I was 28 years old, working as a regional controller for a real estate conglomerate, and the economy was imploding. Prime rates had hit 21½%—a number that would make today's business owners weep. Construction companies were folding left and right.

My boss, the CFO, had just left for another job. The company was hemorrhaging money, particularly in the mortgage division, which was $5 million underwater. We were a public company, one month from fiscal year-end, with auditors coming in for the annual review.

I walked into the CEO's office—a young woman who'd been told her whole life she wasn't smart enough—and said, "I'm willing to take on everything. The entire company."

He looked at me like I'd lost my mind. Then he said, "We're going to try."

That's the moment I stopped thinking like an accountant and became a CFO. Not because of my title, but because of how I approached the problems in front of me.

The CPA Mindset vs. The CFO Mindset

Here's what I discovered in that crucible moment, and what I've been teaching for the past four decades:

Figure 2: created by Joy Francis using Flux LoRA in Magai

CPAs ask: "Are the books balanced?"

CFOs ask: "What story are these numbers telling us, and how do we change the ending?"

CPAs focus on: Historical accuracy

CFOs focus on: Future possibilities

CPAs deliver: Compliance and reporting

CFOs deliver: Strategy and solutions

CPAs get paid for: Time and expertise

CFOs get paid for: Results and transformation

Let me give you a real example. When that problem loan officer from our lead bank called me about a portfolio of mortgages, they were considering purchasing, he wasn't asking me to verify the math. Their mortgage department manager had been doing this for 30 years—I wasn't even 30 years old yet.

He was asking for my judgment. My strategic assessment. My recommendation on whether hundreds of thousands of dollars should change hands.

"Joy," he said, "I trust you know what you're doing. If you say it's okay, I'll buy the loans."

That's CFO work. And it's why CFOs command premium fees that make traditional CPA work look like entry-level pricing.t

The $300 Lesson That Started It All

Figure 3: created by Joy Francis with Flux LoRA in Magai

I learned this lesson years earlier when I was making $100 a week as a bookkeeper. Every month, I'd send our books to the CPA and get them back with his analysis and a $300 bill. I remember thinking, "I can do that."

But I was wrong. I could do the bookkeeping. I could organize the data. I could even prepare the financial statements. What I couldn't do—yet—was what he was really being paid for: the interpretation, the insights, and the recommendations that helped business owners make better decisions.

That CPA wasn't charging $300 for data entry. He was charging $300 for wisdom. For the ability to look at numbers and see opportunities, risks, and solutions that the business owner couldn't see.

That's the difference between a CPA and a CFO. And it's worth a lot more than $300.

The Five Transformational Shifts

If you want to make the leap from CPA to virtual CFO, you need to make five fundamental shifts in how you think about your work:

1. From Reactive to Proactive

CPAs respond to what happened. CFOs anticipate what's coming and prepare for it. According to Profit First methodology, businesses that implement proactive financial management systems see average profit increases of 15-20% within the first year (Michalowicz 89). When a client calls about cash flow problems, don't just help them understand their current position—help them build systems to prevent future problems.

2. From Technical to Strategic

Stop leading with your technical expertise and start leading with business insights. Instead of explaining how you calculated the numbers, explain what the numbers mean for their business strategy.

3. From Compliance to Performance

Shift your focus from "Are we following the rules?" to "Are we optimizing our results?" Compliance is table stakes. Performance is where the value lies.

4. From Reporting to Forecasting

Historical financial statements tell you where you've been. Cash flow forecasts and strategic projections tell you where you're going. The Small Business Administration found that businesses using forward-looking financial planning are 2.3 times more likely to achieve their growth targets (SBA 34). Guess which one business owners will pay more for?

Figure 4: created by Joy Francis using Flux 1.1 Pro Ultra

When you're a service provider, you're a cost center. When you're a strategic partner, you're a profit center. The difference is in how you position yourself and the value you deliver.

The Trust Advantage

Here's something most business consultants don't understand as a CPA, you already have something they spend months trying to build—trust. Business owners already share their most sensitive financial information with you. They already see you as a financial expert.

You don't need to build credibility from scratch. You need to expand the conversation from compliance to strategy.

When I was teaching those financial classes at Ford plants across the country, I wasn't starting from zero with those employees. They already trusted me because I was helping them understand their money. The leap to helping them make better financial decisions was natural.

The Revenue Reality

Let me be blunt about the numbers, because that's what we do—we deal with numbers.

Traditional CPA services: $150-$300 per hour, seasonal demand, price-sensitive clients.

Virtual CFO services: $3,000-$8,000 per month, year-round demand, value-focused clients.

According to the National Association of Certified Public Accountants, the average virtual CFO engagement generates $54,000 annually per client, compared to $8,400 for traditional compliance services (NACPA 41). One virtual CFO client equals 10-25 hours of traditional CPA work per month, but you're delivering exponentially more value. You're not just processing their financial data—you're helping them build wealth, avoid disasters, and achieve their business goals.

The Question That Changes Everything

Here's the question I want you to ask yourself: When your clients have a major business decision to make, do they call you for advice, or do they call you to clean up the paperwork afterward?

If it's the latter, you're functioning as a traditional CPA. If it's the former, you're already thinking like a CFO—you just need to start pricing like one.

The difference between a CPA and a CFO isn't education, certification, or even experience. It's mindset. It's the difference between being a historian and being a strategist. Between being a reporter and being an advisor. Between being a cost center and being a profit center.

And yes, it's worth $10,000 more per client per year. Probably more.

The question isn't whether you're capable of making this transition. The question is whether you're ready to stop thinking like a traditional CPA and start thinking like a CFO.

Because your clients need both. They need someone who can count, and they need someone who can build. The CPAs who figure out how to do both are the ones who'll be charging premium fees while their competitors are still competing on price.

Which one do you want to be?

Works Cited

Michalowicz, Mike. Profit First (page 89)

Michalowicz, Mike. Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine. Obsidian Press, 2017.National Association of Certified Public Accountants - NACPA (page 41)

National Association of Certified Public Accountants. "Virtual CFO Services Market Analysis." NACPA Industry Report, 2023, www.nacpa.org/virtual-cfo-market-analysis.Small Business Administration - SBA (page 34)

Small Business Administration. "Small Business Financial Management Trends." SBA Economic Research, U.S. Small Business Administration, 2023, www.sba.gov/economic-research.

Joy's journey from bookkeeper to CFO of a public company taught her that success isn't about being the smartest person in the room—it's about asking the right questions and having the courage to act on the answers. She now helps CPAs transform their practices by shifting from compliance to strategy.

Get your complimentary copy of “The Cash Flow Crisis Playbook”—the exact 13-week forecasting framework and step-by-step action plans I use to transform panicked client calls into $5,000/month virtual CFO retainers.