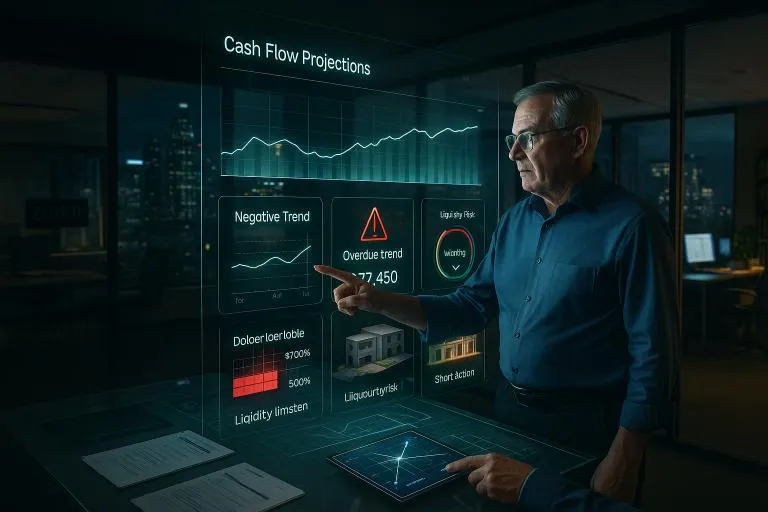

The Cash Flow Crisis

The Cash Flow Crisis: How CPAs Can Save Businesses Before They Fail

Cash flow kills more businesses than bad products, poor marketing, or incompetent management combined. Yet most CPAs only discover cash flow problems after they've become critical—when it's often too late to save the business. After managing companies through economic crises, including the 1980 recession with 21½ percent prime rates, I've learned that early cash flow intervention can mean the difference between business survival and bankruptcy.

The tragedy is that cash flow crises are almost always predictable and preventable. The warning signs are there months before the crisis hits, hidden in plain sight within the financial data that CPAs review regularly. The question is: do you know how to read these early warning signals, and more importantly, do you know how to act on them?

The Hidden Nature of Cash Flow Problems

Cash flow problems are insidious because they often develop while businesses appear profitable on paper. A company can show strong sales growth and healthy profit margins while simultaneously running out of cash to pay bills. This disconnect between profitability and cash flow confuses many business owners—and unfortunately, many CPAs.

When I was working at the real estate conglomerate during the early 1980s, I witnessed this phenomenon firsthand. We had a mortgage company that appeared profitable on paper but was $5 million underwater in cash flow. The problem wasn't immediately visible in the monthly financial statements because the cash flow issues were buried in the timing differences between revenue recognition and cash collection.

According to the U.S. Bank Study of Payment Practices, 82% of business failures are attributed to cash flow problems, yet only 36% of small business owners can accurately forecast their cash flow beyond 30 days (U.S. Bank, "Annual Study of Payment Practices," 2023). This knowledge gap represents a critical opportunity for CPAs to provide life-saving intervention.

The Early Warning System: 13 Cash Flow Red Flags